how much taxes are taken out of a paycheck in ky

In 2022 the federal income tax rate tops out at 37. Generally paycheck calculators will show the take-home salary for salaried and hourly workers.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

The state-level income tax is a flat rate of 5 regardless of your filing status.

. Only the highest earners are subject to this percentage. You are able to use our Kentucky State Tax Calculator to calculate your total tax costs in the tax year 202223. In 2013 the North Carolina Tax Simplification and Reduction Act radically changed the way the state collected taxes.

Another way to manipulate the size of your paycheck - and save on taxes in the process - is to increase your contributions to employer. Put Your Check in a Bank. Your marital status is a key factor that affects your taxes.

The act went into full effect in 2014 but before then North Carolina had a three-bracket progressive. Earners making up to 3110 in taxable income wont need to pay any state income tax as the bottom tax rate in South Carolina is 0. The most common pre-tax contributions are for retirement accounts such as a 401k or 403b.

From each of your paychecks 62 of your earnings is deducted for Social Security taxes which your employer matches. Amount taken out of an average biweekly paycheck. Newest Checking Account Bonuses and Promotions.

For Medicare taxes 145 is deducted from each paycheck and your employer matches that amount. How much do you make after taxes in Kentucky. Federal Insurance Contributions Act FICA Also known as paycheck tax or payroll tax these taxes are taken from your paycheck directly and are used to fund social security and medicare.

North Carolina has not always had a flat income tax rate though. Any income exceeding that amount will not be taxed. Our calculator has been specially developed in order to provide the users of the calculator with not only how much tax they will be paying but a.

A resident of the Big Apple need to pay local income tax 308 to 388 subject to Disability Insurance SDI and Paid Family and Medical Leave PFML has standard deduction and exemption From Wikipedia New York tax year starts from. Federal income tax is usually the largest tax deduction from gross pay on a paycheck. IRS forms and schedules used to figure your taxes 1040 Schedule 1 etc Copies of requested forms or documents verifying income and taxes withheld W-2 1099 etc Payment if you owe taxes and are including a check money order or cashiers check for this instead of paying.

The IRS redesigned some of the Form W-4s. Switch to Kentucky hourly calculator. All filers are subject to the same income tax brackets regardless of filing status.

The amount withheld per paycheck is 4150 divided by 26 paychecks or 15962. Property taxes in South Carolina remain low. Until 2020 you could reduce the amount of taxes taken out of your paychecks by claiming allowances on your W-4.

This paycheck calculator will help you determine how much your additional withholding should be. These are contributions that you make before any taxes are withheld from your paycheck. Calculate your Kentucky net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Kentucky paycheck calculator.

Self-employed individuals have to pay the full 29 in Medicare taxes and 124 in Social Security taxes themselves as there is no separate employer to contribute the other half. In each paycheck 62 will be withheld for Social Security taxes 62 percent of 1000 and 1450 for Medicare 145 percent of 1000. Total income taxes paid.

For example you can have an extra 25 in taxes taken out of each paycheck by writing that amount on the corresponding line of your W-4. If you increase your contributions your paychecks will get smaller. Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates.

If you are an employee for two different employers you only claim dependents on one of your W-4s the one for the highest-paying of the two jobs. Amount taken out of an average biweekly paycheck. However there is a deduction available during tax season to help.

So if you elect to save 10 of your income in your companys 401k plan 10 of your pay will come out of each paycheck. That changed in 2020. A single filer with an annual paycheck of 72000 will take home 5384039 after taxes.

Now you claim dependents on the new Form W-4. It is levied by the Internal Service Revenue IRS in order to. A married couple earning 144000 per annual will get 10768078 after taxes.

Every taxpayer in North Carolina will pay 525 of their taxable income for state taxes. A single filer making 49000 per annual will take home 3881950 after tax. Kentucky Salary Paycheck Calculator.

Work out your adjusted gross income Total annual income Adjustments Adjusted gross income calculate your taxable income Adjusted gross income Post-tax deductions Exemptions Taxable income. Figure out your filing status. A paycheck calculator lets you know what amount of money will be reserved for taxes and what amount you will actually receive.

For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax. You pay the tax on only the first 147000 of your earnings in 2022. Calculating your Texas state income tax is similar to the steps we listed on our Federal paycheck calculator.

Mortgage rates also fall below the. Connecticut recognizes same-sex marriages for income tax purposes so keep that in mind when filling out your W-4. Taxable income of 15560 or more is subject to South Carolinas top tax rate of 7.

They can also help calculate the amount of overtime pay will be paid out directly in your check. Depending on the state where the employee resides an additional amount may be withheld for state income tax. The check stub also shows taxes and other deductions taken out of an employees earnings.

For a married couple with a combined annual income of 98000 the take home pay is 77639. How much comes out of your paycheck is determined in part by whether you are single the head of household married filing jointly or married filing separately.

Taxes On Stocks How Do They Work Forbes Advisor

2022 Federal State Payroll Tax Rates For Employers

/how-do-401k-tax-deductions-work-90f14263254d470fb07b75f2bf664174.png)

How Do 401 K Tax Deductions Work

Peoplesoft Payroll For North America 9 1 Peoplebook

Where Your Tax Dollar Goes Cbc News

Where Your Tax Dollar Goes Cbc News

6 Common Miscellaneous Expenses Examples Tax Deduction Tips For Small Businesses

Ways Self Employed Professionals Can Lower Their Tax Burden

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

9 Concepts You Must Know To Understand Uber Eats Taxes Complete Guide

Payroll Tax What It Is How To Calculate It Bench Accounting

When You Make Pre Tax 401 K Contributions You Won T Miss The Whole Amount From Your Paycheck Financial Literacy Lessons Personal Finance Lessons How To Plan

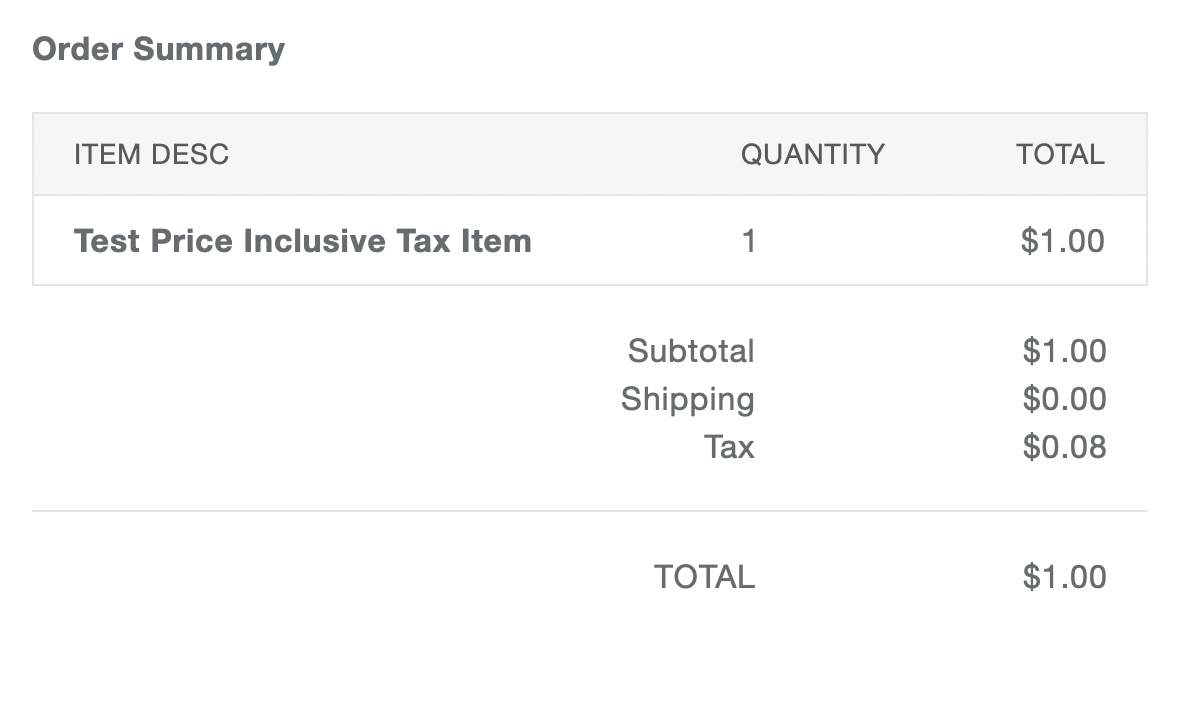

Square Online Tax Settings Square Support Center Us

Payroll Tax What It Is How To Calculate It Bench Accounting

2022 Federal State Payroll Tax Rates For Employers

Why Your Paychecks Might Be Bigger Right Now Nextadvisor With Time

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)