tax lawyer vs cpa reddit

Many tax lawyers end up making 400000 or more as tax directors. Each plays a distinct role and theres a good rule of thumb for choosing one.

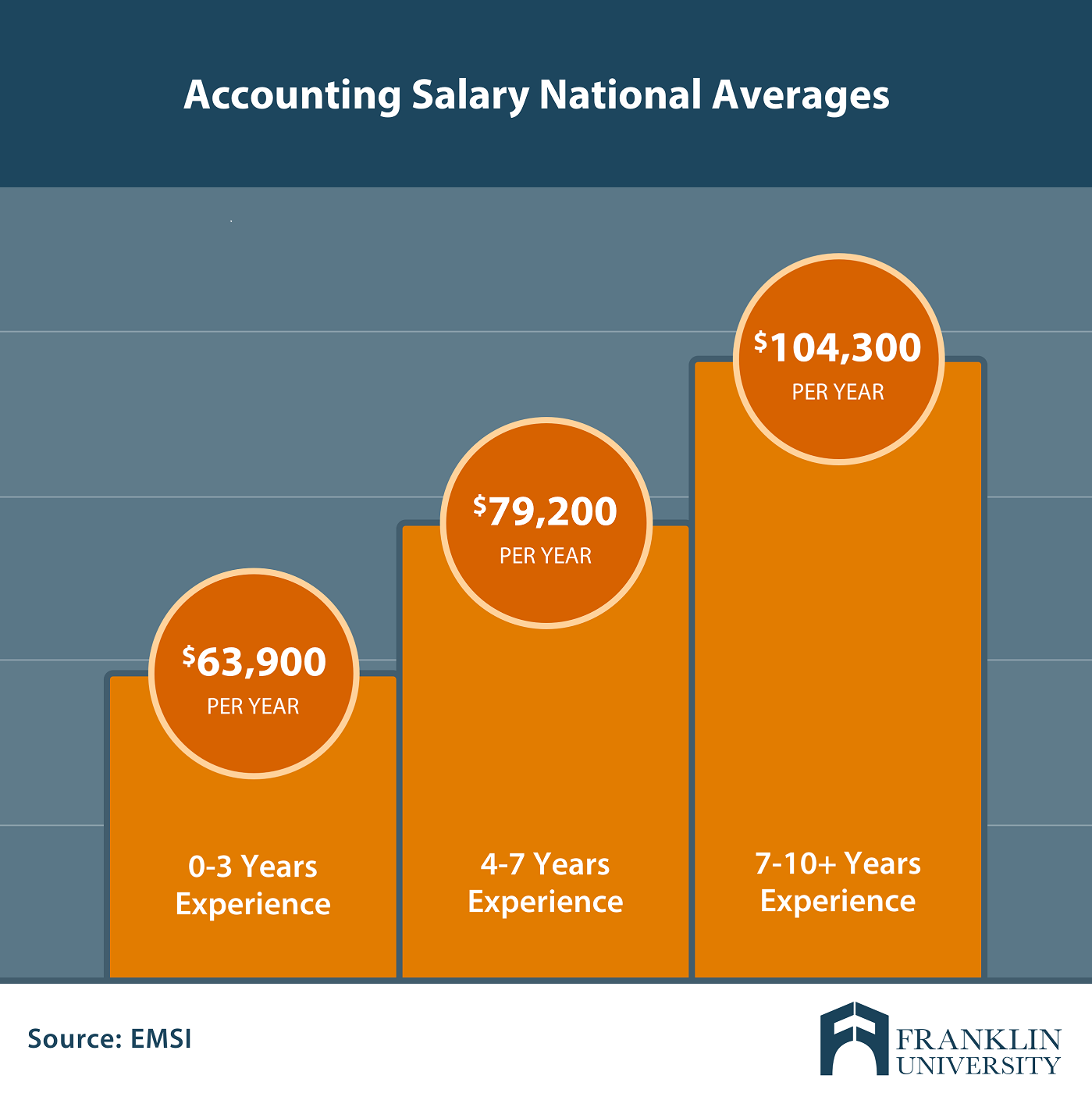

Master S Degree In Accounting Salary What Can You Expect

A tax lawyer can look at your expenses compared to your income and evaluate what your quarterly expenses should be.

. The law job market is currently pretty abysmal and has been for some time. One of my interviewers for a investment firm graduated as an accounting major at my school did audit 2 years went to law school and landed a job at his current gig as a tax attorney. A tax attorney is a lawyer who knows how to review your tax decisions to see what the IRS allows.

We just like coming to Reddit to complain. The average law graduate has 140000 in student loan debt so going this route may cost you a lot of extra money to end up in pretty much the exact same spot employment and salary-wise. CPAs work with taxes and accounting while CFPs tend to work with clients on financial plans.

A CPA and CFP are both common financial professionals. You may work in the accounting field without a CPA license which is different from the legal profession which requires a legal license for most areas of practice. There is heavier accounting work at the Big 4 even if youre mainly in a transactions or.

Apply for a summer internship at a tax law firm after your first year of law school to gain valuable experience and increase your chances of finding employment after graduation. From there your tax lawyer can make a suggestion about how much you put in every quarter. In fact the IRS says they are uncontested experts on such topics.

One of the biggest advantages of hiring a tax lawyer over a CPA is the protection of your business through attorney-client privilege. Secondly Im genuinely passionate about helping others. The Roles of an International Tax Attorney.

Klasing worked for nine years as an auditor in public accounting. Prior to becoming a tax attorney Mr. 3y Audit Assurance.

An EA is the highest credential the IRS awards. Additionally the need for tax accountants will only go up if tax reform gets passed. This makes the planning process easier for my clients who know that I have all their bases covered.

My attorneys firm charges 450hour for attorneys and 210hour for paralegal work and they want a 3250 down payment. There is a clear difference in the focus and skillset of an attorney vis-à-vis the focus and skillset of an attorney. If you do end up in court this legal protection of communications between you and your lawyer means you can seek help without the risk what you share privately coming out publicly in a trial.

Accounting and the law are both fields in which professionals can work either at a firm of fellow professionals serving. If you want to know whether you can or cant do regarding taxes what the IRS will allow. Klasing with your tax strategy needs you gain the benefit of an experienced international tax lawyer and a seasoned CPA for the price of one.

When you entrust the Tax Law Offices of David W. A CPA-attorney when asked what he does for a living replies that he practices tax. Conversely if a dual-licensed Attorney-CPA decides to continue an accounting career he has a distinct advantage over most CPAs due to his familiarity with the.

If you need someone to handle the numbers to tell you what you have and what you owe you want a CPA. Law school costs a lot of money and normally much more than a CPAMasters in Tax will. To give a comparison Id usually leave the office at the Big 4 at around 1730 when training and would only need to be online late very occasionally - at law firms the norm is to leave at around 1930-2030 with US firms pushing it to 2100-2200.

On one hand an accountant is focused on ensuring that based on the information and documents received from the taxpayer that computations and calculations are accurate. The good news if you overpay youll get that money back in the form of a tax return. How much do CPAs and lawyers typically charge to prepare estate tax returns form 706 for a relatively simple estate.

Youll want to seek out an EA for any and all tax-related issues. A professional with this designation typically makes between 15000 and 20000 more than CPAs annually. Tax Attorney vs.

At the outset many tax lawyers can make up to 100000 as an associate at a big 4 accounting firm. The benefits of a dually-certified professional. Accounting skills you possess especially tax and personal finance will help you more effectively build your net worth and operate with a financial safety net.

Tax law is some of the most complex and convoluted law there is so. In order to make the most money in the big 4 in either practice you need to go into a practice that is in high demand. With respect to that last scenario if you dont have the background to be a serious candidate for a tax-focused legal job then your analysis is pretty straight forward in terms of cost-benefit.

What Is a Certified Public Accountant CPA. Mortgage Calculator Rent vs Buy. As compared to medicine or law and a bunch of other fields you can be earning four years.

Earn your juris doctor degree JD which typically takes three years. By being both a CPA and lawyer my ability to understand the numbers as well as the legalities associated with estate planning help me bridge that gap. While a tax attorney is typically reserved for more specific and complex tax issues whereas the CPA is usually utilized on a more regular basis to keep your financial records in order and prepare your taxes the advantages of having a two-in-one professional are hard to overstate.

Menu burger Close thin Facebook Twitter Google plus Linked in Reddit Email arrow-right-sm arrow-right Loading Home Buying Calculators How Much House Can I Afford. Both the CFA and CPA designations require passing examinations and meeting educational requirements. 866 303-9595 or 845.

Tuition is upwards of 50000 plus cost of living so it isnt prohibitively expensive for a graduate degree unless you are already sinking in debt. This is understandable according to James Mahon a shareholder in the Tax and Litigation practice groups of law firm Becker Poliakoff. If a tax lawyer wants to be a principal at a big 4 accounting firm they can make in excess of 1 million.

Hes kind of living the life right now. A CFA generally analyzes financial reportsnotably financial statements while. Here are seven options you have to pay the IRS when you owe taxes from an attorney and CPA who concentrates in tax planning and estate planning.

In the tax area the lines between accountants and attorneys can be blurred. In conclusion tax accountants make more money than auditors on average and in my experience they earn about 10 more. As an accountant you may prepare taxes and do bookkeeping although a CPA license allows you to represent a tax client before the IRS and sign off on audits carrying higher prestige and salaries.

Convicted Felon Future Cpa Hopefully R Accounting

How To Become A Cpa Without A Degree In Accounting It Can Be Done

How To Pass Cpa Board Exam Philippines 10 Effective Tips

Puffin115110 Men S Value T Shirt Half Man Half Puffin Light T Shirt Cafepress T Shirt Short Sleeve Tee Shirts Everyday Essentials Products

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

![]()

Salary Breakdown Of The Big 4 Accounting Firms

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

Cpa Vs Cfa Vs Acca Vs Cma Which One Is The Right Credential For You

Tax Attorney Vs Cpa Guide Why You Might Need A Tax Attorney

![]()

Cfa Vs Cpa Crush The Financial Analyst Exam 2022

Turbotax Vs Accountant When Should You Hire A Cpa

A Desktop Computer Sitting On Top Of A Desk Coworkers Upgrade Software Of Employee On Vacation Funny Pictures Laugh Best Funny Pictures

I Had To Do It Accounting Humor Accounting Finance Infographic

Is It Worth It Getting Your Cpa What Can You Do With It Quora